If you didn’t read the small print before you installed you may have restarted your Mac to a bit of an unpleasant surprise. Rosetta, the invisible emulation environment that was a part of both Leopard and Snow Leopard and allowed you to run PowerPC applications, has gone the way of the dinosaur with Lion. Unfortunately, this means that Quicken, Intuit’s deprecated but still ubiquitous personal finance management application, will no longer work on your Mac. ( ) is available for the Mac, but in terms of features and capabilities, it is not equal to nor a replacement for Quicken. How do you manage your personal finances if Quicken won’t work with Lion?

Fortunately there are several alternatives to help you keep tabs on your cash flow. IBank IGG Software’s (; $60, ) has long been the heir apparent to the Mac personal finance empire.

Thoughtfully designed and easy to use, iBank is updated on a regular basis and the developer is attentive to customer needs, which means that the features you want typically show up when the application is updated. What makes iBank a worthwhile replacement for Quicken is the fact that, like Quicken, it is capable of automatically downloading your banking information. What’s more, if iBank can’t import the data automatically, it’s intelligent enough to use your bank’s Web banking site to automatically import the files that you download manually. Great graphs, great features, and intelligent design make iBank an excellent Quicken alternative.

Moneywell No Thirst Software’s ($50; ) remains one of my favorite personal finance applications largely because it helps you budget your finances, rather than just helping you see where you’ve spent your money. This makes Moneywell different—and I think better—than almost every other personal finance application currently available for the Mac. Moneywell uses the “envelope” method of money management to help you divvy your dollars up before you spend them. This makes it quick and easy to see whether or not you’re living within your budget and it also makes it possible for you to take cash from one category and, when necessary, use it in another. Like iBank, Moneywell makes it easy to import your banking data, and offers excellent graphs and a number of other tools to manage your income and expenses.

Money 4 ($19; ) is Jumsoft’s Quicken alternative and, like iBank, is often updated and constantly adding new features. Money 4 has the look and feel of most Apple applications, a small sidebar on the left displays a list of all your accounts and a collection of the tools you’ll need to view reports and manage your finances. While Money 4 doesn’t quite have the depth of features of iBank or Moneywell, it offers up enough (including thirteen financial reports) to help you keep a tab on your finances. It also does a great job of importing the banking files you download from your bank. Mint.com While it’s easy to complain about Intuit and the fact that they seem to have left Quicken users out in the cold, you may want to consider the company’s stellar online personal finance management alternative, (free).

While you may be reticent to leave your financial data hanging around in the cloud, there are some features about this web-based app that make it particularly valuable. First, it’s capable of connecting to and automatically collecting data from virtually every financial institution that you work with, from your mortgage company to your local bank. Second, with a very little bit of training, Mint.com can take that data, categorize and analyze it so that you can see exactly how your cash is flowing and where you need to tighten your belt. The only downside is that, while Mint.com is free, you will find yourself being gently pitched for new credit cards and bank account options. Plus, the cloud can be a scary place to keep your personal banking info. That aside, for me, Mint offers the best, most Quicken-like experience of all the applications offered here. A word to the wise Chances are that if you’re a long time Quicken user, you’ve invested quite a bit of time in the application and you have a significant amount of data saved in the application.

Before you upgrade to Lion you’ll need to export that data in a format that that can be imported using whatever application you’re planning to use once you make the switch. Most of the applications mentioned here can import QIF or CSV files, but you’ll want to make sure that you can import the data before you upgrade. Fortunately all the applications mentioned here will work in both Lion and Snow Leopard, so you can make sure that everything works properly before you make the switch. Jeffery Battersby is a regular contributor to Macworld. Get more Jeff than you want on the Revenge of the Fanboy! Podcast and at.

Editor's note: Updated 8/8/11 with information about Quicken Essentials.

© CreditDonkey Quicken set out to create a program that was at least comparable to its sibling, Quicken for Windows. Did it accomplish that goal?

Many users don't think so, but they do recognize the improvements made in the program. Some of the most important improvements made include:. A more user-friendly interface.

More cohesiveness between mobile app and Quicken for Mac. More reporting options Did Quicken accomplish what they set out to do? Keep reading to find out. How Does Quicken for Mac Work? One thing you should understand about Quicken for Mac: just likes its Windows counterpart, you must subscribe to the service.

Quicken Software For Mac

The subscriptions are available in one and two-year increments. This means every year (or two years), you must renew your subscription.

Quicken offers three versions for Mac users:. Starter: As the name suggests, it's a starter program, good for those who have never officially budgeted their finances. Don't expect any bells and whistles with this option. Deluxe: If you are ready for more, the Deluxe program helps you customize your budget, track your debt, manage your debt, and monitor your investments. Premiere: The top tier program includes everything in Deluxe, plus online bill pay service (free of charge) and quicker access to customer service. Contacting Quicken: Quicken offers two ways to contact customer support:.

Phone support is available Monday - Friday, 5 AM to 5 PM Pacific Time. Live chat is available 24/7; you can see the wait time for an agent right on the website What Are the Fees? As we discussed above, Quicken is a subscription-based service. You will pay anywhere from $34.99 to $74.99 per year for the service. If you neglect to renew your subscription, you can still access your information, but you cannot use the program's services any longer. Converting from Quicken for Windows to Quicken for Mac Previously, Mac users had to run Quicken for Windows via VMWare Fusion or run an old version of Quicken for Mac. This allowed them to run Quicken on a Mac without having a program made for Mac.

These users who now pay for the Quicken for Mac subscription can move their Quicken files over to Quicken for Mac. Quicken does offer full support to help you transfer the files, no matter how many years of transactions you have going at the time of transfer. Reasons We Like Quicken for Mac. You can sync your financial data between the desktop app and the mobile app. The Quicken mobile app is free and syncs with your desktop app.

This way you can add, edit, or delete transactions on either device and they will synchronize the information so you are always looking at the most up-to-date data. You can easily reconcile your accounts. If you don't reconcile your accounts, you may be using incorrect information. Reconciling is a feature in Quicken for Mac that is simple to use. It's like a system of checks and balances that lets you know the information you put into Quicken for Mac matches the information the bank provides. Quicken for Mac provides visually appealing graphs and charts. Quicken for Mac is easier to navigate and read for users.

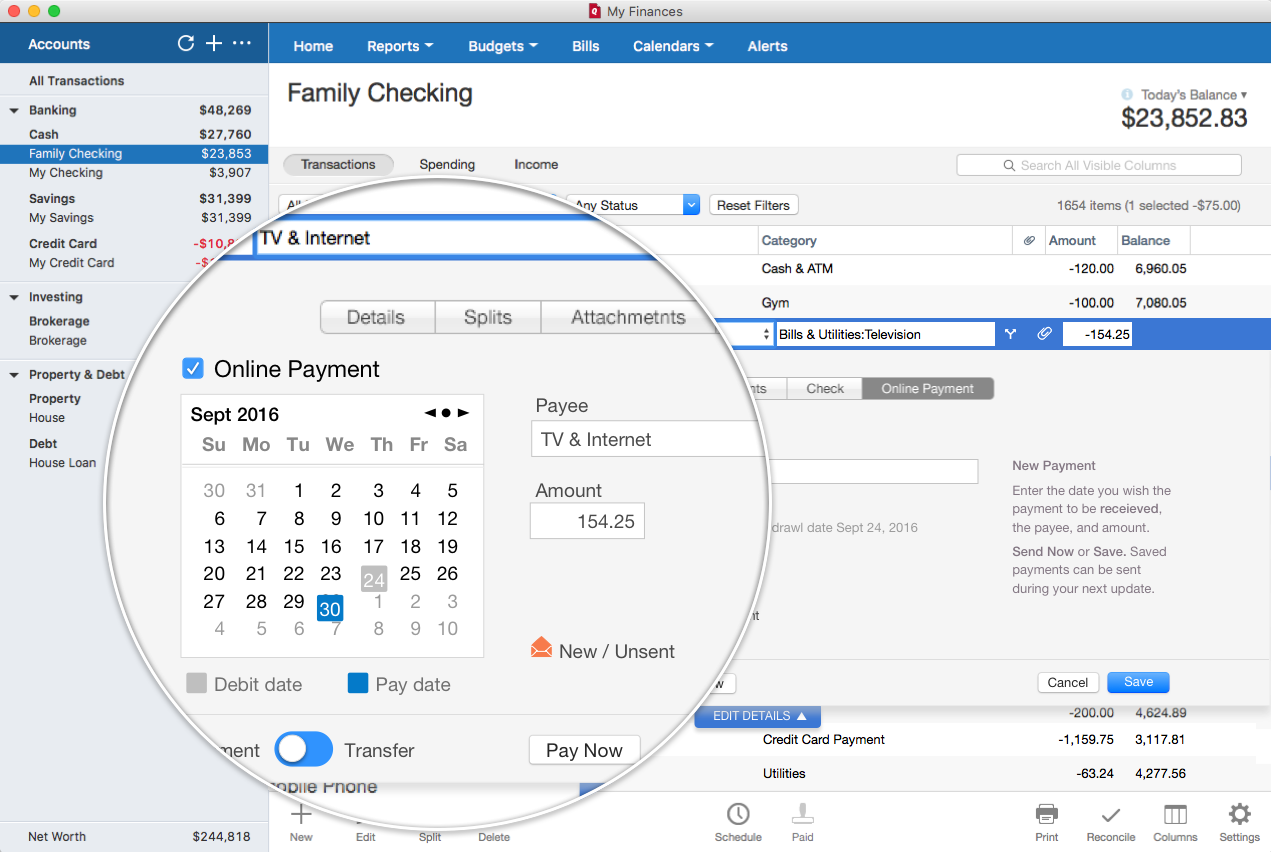

You can view ledgers, graphs, or charts—whichever is the most appealing to you and will help you stay on track with your budget. You can pay bills via Quicken for Mac.

Quicken for Mac has access to more than 11,000 vendors. You can view all of your bills on the dashboard and/or you can download your bills in PDF format if you prefer to have a copy of the bill yourself. You can manage your investments. A new key feature of Quicken for Mac is the investments feature. You can track your portfolio, get updated quotes, and track your profits.

You can also see your cost basis, determine your capital gains, and prepare yourself for tax time. You can track your principal and interest on loans. If you are trying to get ahead of your loans, you will like the loan feature in Quicken for Mac. You can see how your payments affect principal and interest. You can also run 'what if' scenarios to see how different payments and scenarios would help you pay off your debt.

You can use Dropbox for backups. Even though Quicken for Mac is on your local computer, you get access to 5 GB of online backup from Dropbox. This gives you a 'backup' of your financial information to ensure that you don't lose anything.

You always have the latest updates. Because Quicken for Mac is subscription-based, you don't have to upgrade the product when new versions are released. You'll automatically receive updates, which means you'll always have the latest features available to you. You don't lose access to your financial data even after your subscription ends. If you don't want to renew your subscription, you still have access to your financial data. You can view it, edit it, or export it.

While you can't use Quicken's features, you won't lose the information you collected while you did pay for the program. Quicken supports more than 14,000 financial institutions for automatic update of your financial information.

This is the same number of financial institutions Quicken works with for the Windows version, so Mac users are on the same wavelength as Window users in that regard. Reasons You May Want to Look Elsewhere. There is little difference between the Premier and Deluxe versions. The only differences are the online bill pay (free of charge) and faster priority for customer service.

Convert Quicken Mac To Pc

For many users, that may not be worth the extra $30 per year, especially when most banks offer free bill pay. Investment reporting still lacks features offered in Quicken for Windows. While Quicken for Mac 2018 has dramatically better investment features, it still pales in comparison to Quicken for Windows' features. The main features that lag are in terms of reporting, which is the one feature many users want when looking at their investments. You have to pay for it every year. Quicken for Mac used to be a native program that you downloaded to your computer and used for as long as you wanted. If you wanted to use an old program, that was your prerogative.

Now you don't have that choice—you have to pay the subscription fee or you can't use Quicken for Mac. How It Compares QuickBooks for Mac: QuickBooks for Mac offers similar features to Quicken for Mac, but QuickBooks also caters to small businesses.

Why Is Quicken For Mac So Bad

Quicken is more for personal finance use. If you don't manage payroll or your business has simple financing needs, Quicken may suffice. Businesses that need more robust financing options, though, may do better with QuickBooks for Mac. Quicken for PC/Windows: While Quicken for Mac made many improvements for 2018, it's still not the mirror image of that many users want. The navigation in the Windows version is still easier. Also, the reporting options in the Windows version are more robust. Bottom Line If you can overlook the subscription fees for Quicken for Mac, it does pack quite a punch being a native program for Mac users.

While it does lack certain features, it's a major improvement over the previous versions. With the subscription-based service, you do have the benefit of quick fixes when issues arise and always having the latest version at your fingertips.

More from CreditDonkey. About CreditDonkey® CreditDonkey is a stock broker comparison website. We publish data-driven analysis to help you save money & make savvy decisions. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. †Advertiser Disclosure: Many of the card offers that appear on this site are from companies from which CreditDonkey receives compensation.

This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). CreditDonkey does not include all companies or all offers that may be available in the marketplace.See the card issuer's online application for details about terms and conditions. Reasonable efforts are made to maintain accurate information. However, all information is presented without warranty. When you click on the 'Apply Now' button you can review the terms and conditions on the card issuer's website. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice.

You should consult your own professional advisors for such advice.